Holiday bonuses have long been a way to show appreciation for employees. While there are many ways to show appreciation, most of the time, employees prefer receiving cash bonuses the best. In fact, if a company has paid cash benefits in the past, then employees may be expecting and counting on a Christmas bonus to pay for holiday expenses or other bills.

No matter how you’re getting your holiday bonus, still, there’s nothing like seeing a little holiday cheer in your paycheck at the end of the year. Read on tips that can help you get a head start on your holiday bonus.

Table of Contents

What kind of employee bonuses do companies give?

Some businesses give year-end bonuses based on individual employee performance. Other businesses give bonuses based on the percentage of individual employee salaries, and others give a flat amount to all employees regardless of their salary. Here is a handy cheat sheet on the different types of bonuses that top companies offer.

Spot bonus

A spot bonus is a gift given to employees on the spot for completing a specific task. This type of work bonus is mostly given in the form of cash. A spot bonus sparks the initiative characteristics of workers to perform above and beyond.

Referral bonus

Referral bonus is a great alternative to include in your rewards and recognition program and help with your HR department’s workload management. This is given when an existing worker recommends an acquaintance for a job.

Holiday bonus

This may be the most common bonus that employers give to their workers. A holiday bonus is a gift to employees during the festive seasons. This practice is mainly prevalent during Thanksgiving, Christmas, and New Year periods.

Profit-sharing bonus

Unlike an annual bonus, a profit-sharing bonus awards employees a percentage of the company’s profits and is based on the company’s actual earnings over a set period of time. Employees only benefit from this when a company sees profit.

Commission

Most popular among sales teams, commission plans are based on the amount of money or revenue a salesperson earns in the sales they have made. Commissions complement a base salary and are very clearly defined at the top of the year through a sales commissions structure.

Smart things to do with your year-end bonus

Instead of splurging all that bonus, make a plan to allocate it wisely in line with your long-term financial goals, while still setting aside some money to enjoy the fruits of your labor. Here’s how to make the most out of it.

1. Pay down debt

If you have a high-interest debt running, a part of your bonus can help shave a part, if not all of it off. You’ll breathe easy knowing you owe no financial debts to anyone.

2. Start or grow your emergency fund

The past years have taught us one big lesson – always be prepared for emergencies. Throw some part of your bonus into your emergency fund or use it to create one if you still don’t have it. It is important to have a financial cushion in case of life’s unexpected moments.

3. Invest in your goals

Whether those goals include putting aside money for your children’s university education, financing your business, renting a bigger apartment, buying a portion of land, getting an MBA abroad, and more; your bonus will help you get close to achieving it.

4. Invest in yourself

Perhaps there’s a skill you’ve always wanted to learn – one that could help improve your earning power or land you an entirely more lucrative job? Use your bonus to develop that skill and that’s you investing in your future.

5. Treat yourself

While we recommend saving and investing most of your bonus, it doesn’t mean you shouldn’t spend a little on yourself. Go for a relaxing massage or enjoy a staycation over the weekend – you deserve it after working hard the whole year.

Frequently Asked Questions About Holiday Bonus

Q: Where can I spend my bonus money?

A: Here’s a list of ways to spend that money that might benefit you the most:

- Pay down debt

- Start of grow your emergency fund

- Invest in your goals

- Invest in yourself

- Treat yourself

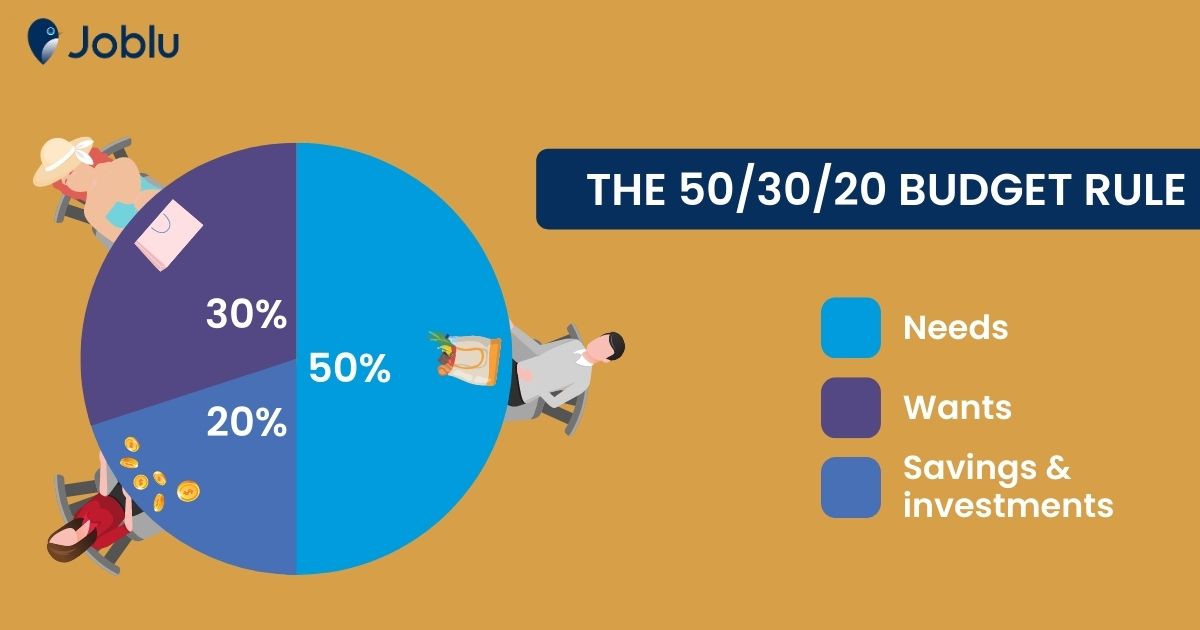

Q: What percentage of your bonus should you save?

A: The 50/30/20 rule is an easy budgeting method that can help you manage your holiday bonus more effectively. 50 percent of the money goes straight to your bank – while 30 percent goes towards funding your lifestyle, and 20 percent for savings or paying off debt.

Q: What are the fun things to spend a bonus on?

Spend your money wisely while still having some fun or doing something for yourself–take a mini-vacation, do something for the kids (if you have children), buy a new mattress, and many more!

Hopefully, this article has made you think a little harder about what you’d like to spend your big bonus on this year. What you use doesn’t have to be on this list, but it should be something you’ve made a conscious, thoughtful decision about.

If you’d like to have a job that matches your lifestyle goals, visit Joblu now.